Why Australia’s food precinct revolution needs bold creativity, robust research, and real world strategy

Every shopping centre professional reading this article has the same dream: a Chadstone Market Pavilion of their own. With nearly 2,000 seats, curated concepts, a champagne bar, and even a bagel and oyster counter, itʼs the type of offering that redefines what food in retail can be. It’s no wonder it’s the envy of the industry.

But here’s the reality: there are fewer than 30 super-regional shopping centres in Australia with a trade area profile to support an ambitious

“Market Pavilion” style concept. Meanwhile, there are over 1,000 sub-regional and neighbourhood malls — centres without the scale, budget, or footprint of a Chadstone, but with just as much pressure to perform.

The Calm Before the Storm: Why Food Courts Must Evolve

On the surface, Australiaʼs food courts are thriving. Foot traffic is up. Sales are strong. Casual dining customers are trading down to food court options. Immigration and hybrid work are fuelling weekday traffic. Rising construction costs have paused new developments, funnelling more shoppers into existing centres. In most cases, tenants are renewing with enthusiasm, making for simplified leasing and less incentive requirements. It all looks fine — until you dig deeper.

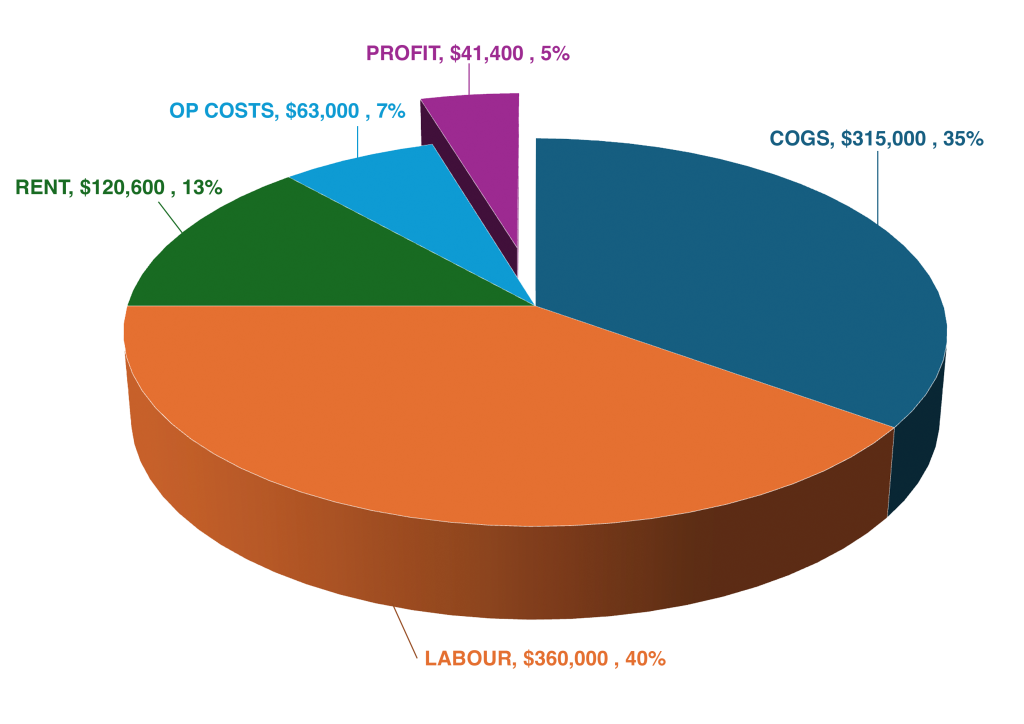

Behind the headlines, profitability is eroding. Wage, food and utility costs have pushed operator net margins down to just 4–6%. In a typical sub-regional mall, that equates to around $40,000 profit per year — or about$110 a day. No operator can survive long on those numbers.

For landlords, the risk is clear, it wonʼt take much – lowering migration or return to office mandates that reduces foot traffic, lowering construction costs that ramps up developments, an uptick in unemployment or a global conflict and suddenly there will be: tenant churn, declining asset performance, and underutilised precincts.

A Foundation Worth Building On

Food courts may be under pressure, but theyʼre not obsolete — far from it. They remain unmatched in two key areas: speed and scalability. A Grillʼd in an external lifestyle precinct might take more revenue, but the food court McDonaldʼs will serve four times as many customers. Food courts convert general foot traffic in to customers with brutal efficiency.

Their strategic placement — best between major drawcards like discount department stores and car parks — ensures high flow-through. The key is unlocking their next evolution.

Having studied Australian food courts and hospitality precincts for over 30 years, Titanium Food believes every centre — no matter its size — has an opportunity to extract more value from its F&B offer.

But doing that requires two things:

- Robust, independent research that goes beyond rent roll metrics and anchor performance

- Creative, future-proof planning that responds to how Australians are actually living, working and eating now and how that will change in the future

And letʼs be honest — thatʼs not something that can be done from inside the same boardroom thatʼs executed minimal redevelopments in the last five years. You need a partner who brings fresh eyes, hard data, and a challenger mindset.

The Opportunity: Real World, Real Wins

So what does next-gen F&B strategy look like for sub-regional and neighbourhood centres? Itʼs not about imitating Chadstone. Itʼs about scaling smart ideas to fit your context. Hereʼs how:

- Design for the New Meal Mindset

Consumers are cooking less, snacking more, and replacing traditional meals with quick service and grab-and-go. Ghost kitchens, delivery apps, and “third space” dining are altering where and how people eat. Your precinct must reflect this. Titanium Food helps centres rethink their layouts, tenant mix, and delivery flows to align with changing consumption patterns. That might mean:

• Adding takeaway-friendly kiosks at external edges

• Creating smart locker zones for delivery and pickup

• Redesigning seating to support solo diners, flexible families, and seniors

• Introducing hybrid fresh-food-meets-ready-meal vendors - Digitise or Die

The gap between food tech leaders and laggards is widening.

Third-party platforms are squeezing margins, but few centres have invested in their own white-label ordering and loyalty systems. Titanium Food helps centres reclaim control of the customer journey — with kiosk tech, app ordering, AI-driven upselling, personalised promotions and even in centre delivery.

Our research shows that digitisation can increase average transaction values by up to 27%. But just as important is what it does for the operator profitability: fewer errors, lower labour overheads, and higher throughput at peak periods.

White lable apps take the power of the customer relationship away from the third party platforms, massively reduce the 30% commissions they take and returns the responsibility for traffic generation back to the Landlord. - Reclaim the Night

Most suburban food courts shut down by 3pm. Meanwhile, the neighbourhood around them stays wide awake.

We help landlords develop realistic, cost-effective strategies to extend trading hours — whether that’s licensing select operators, converting underused tenancies to evening-friendly uses, or opening up food zones to external access.

Even one or two smart nighttime offers — think dessert bars, noodle counters, or community dining events — can transform how a centre is perceived after dark.

- Plan for Placemaking, Not Just Seating

It’s not just about more tables. It’s about intentional design that invites people to linger.

We’ve helped centres use every trick in the book — from pet-friendly patios to kids’ play zones, water features, and passive art installations — to turn food zones into dwell-time magnets.

It’s not about gimmicks. It’s about understanding who your customers are, how they move, and what would make them stay an extra 15 minutes (and spend an extra $15). - Embrace Emerging Cuisines

Australia’s multicultural profile is rapidly changing — and aging. That means new tastes, new formats, and new cultural rituals around food.

From Korean street food to Filipino bakery cafés, West African grills to Persian-style dessert kiosks, there’s untapped demand hiding in plain sight. But finding the right mix takes research, not guesswork.

Make sure you work with experts that develop precinct strategies that forecast future demand — not just what’s trending now through nuanced, food centric analytics, market intelligence and trend spotting.

Reinvention Isn’t Optional — It’s Urgent

Australia’s food courts — some dating back to icons like Roselands’ Raindrops — have served us well for decades. But history doesn’t pay the rent. It’s time to ask: what will your food precinct look like in five years?

Will it be a relic of yesterday’s model — or a reimagined asset that drives visitation, dwell time and spend?

Titanium Food throws out the challenge to the industry. Not with cookie-cutter concepts, but with bespoke, data-backed strategies and fierce creativity grounded in the real world.

Because while Chadstone is one in 30, your Centre, dear reader, is more likely to be one in 1,000 — and your opportunity is just as exciting.

NO PITCH, NO PRESSURE!

Just insight tailored to your centre